When it comes to travel insurance, the ability to cancel for any reason is a game-changer. With John Hancock Travel Insurance Cancel for Any Reason, you have the flexibility and peace of mind you need for your travels.

This policy allows you to cancel your trip for any reason, giving you added protection and security. Let’s dive into the details to understand how this type of policy can benefit you.

Overview of John Hancock Travel Insurance Cancel for Any Reason

John Hancock Travel Insurance offers a ‘cancel for any reason’ policy, providing travelers with added flexibility and peace of mind. This type of policy allows travelers to cancel their trip for any reason, even reasons not covered by standard trip cancellation policies.

Benefits of Cancel for Any Reason Policy

- Flexibility: Travelers have the freedom to cancel their trip for any reason, whether it’s a sudden change of plans or unexpected circumstances.

- Peace of Mind: Knowing that they can recoup a portion of their non-refundable trip costs can alleviate stress and uncertainty.

- Additional Coverage: Cancel for any reason policies typically offer higher reimbursement percentages compared to standard trip cancellation policies.

Examples of Useful Situations

- A family emergency arises shortly before the trip, and the traveler needs to cancel their travel plans.

- Work obligations unexpectedly prevent the traveler from taking time off for the planned vacation.

- Health concerns or travel advisories prompt the traveler to reconsider their trip and cancel for safety reasons.

Coverage Details

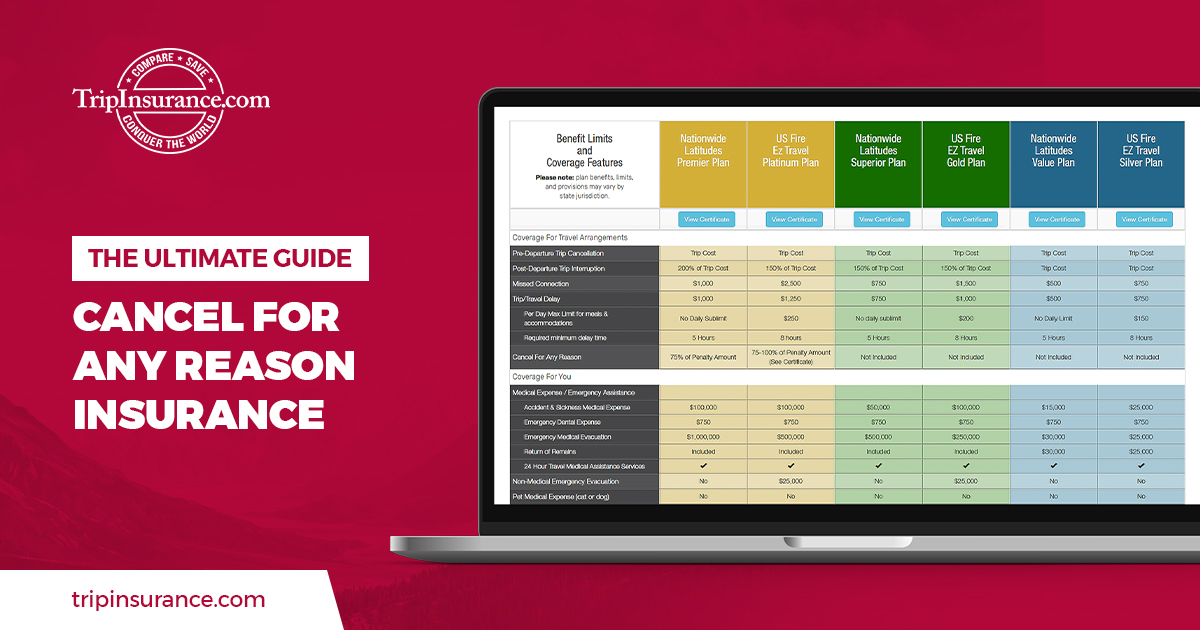

When it comes to John Hancock’s cancel for any reason policy, travelers can expect a more comprehensive level of coverage compared to a standard travel insurance policy. This type of policy provides the flexibility for travelers to cancel their trip for any reason and receive a percentage of their non-refundable trip costs back.

Typical Coverage Under John Hancock’s Cancel for Any Reason Policy

- Reimbursement for a percentage of non-refundable trip costs

- Coverage for trip cancellations due to any reason, not just covered reasons specified in a standard policy

- Flexibility and peace of mind for travelers who may need to cancel their trip for unforeseen circumstances

Comparison with Standard Travel Insurance Policy

Unlike a standard travel insurance policy, which may only cover trip cancellations for specific reasons such as illness or natural disasters, a cancel for any reason policy offers broader coverage. This means that travelers have more flexibility and control over their travel plans, knowing that they can cancel for any reason and still receive some reimbursement.

Exclusions and Limitations

- Typically, cancel for any reason policies may have a higher premium cost compared to standard travel insurance policies

- Reimbursement percentage may vary, usually ranging from 50% to 75% of non-refundable trip costs

- There may be specific eligibility requirements or conditions that travelers need to meet in order to qualify for this type of coverage

How to Cancel for Any Reason

When it comes to canceling a trip for any reason with John Hancock Travel Insurance, there are specific steps and requirements that need to be followed. This process involves filing a claim under this type of policy and providing certain documentation to support your cancellation.

Steps for Canceling a Trip for Any Reason

- Contact John Hancock Travel Insurance as soon as possible to notify them of your intent to cancel your trip for any reason.

- Provide details of your trip, including the reason for cancellation, to the customer service representative assisting you.

- Follow any specific instructions provided by John Hancock Travel Insurance regarding the cancellation process.

Requirements for Filing a Claim

- Submit a claim form to John Hancock Travel Insurance, detailing the circumstances surrounding your trip cancellation.

- Include any supporting documentation requested by the insurer, such as medical records, proof of cancellation from the travel provider, or other relevant information.

- Ensure that you meet the criteria Artikeld in your policy for canceling for any reason, as failure to do so may result in your claim being denied.

Documentation Needed when Canceling for Any Reason

- Proof of payment for the trip, including receipts or credit card statements showing the transaction.

- Confirmation of the reason for cancellation, such as a doctor’s note, death certificate, or other supporting documentation.

- Any communication with the travel provider regarding the cancellation, including emails or cancellation notices.

Tips and Considerations

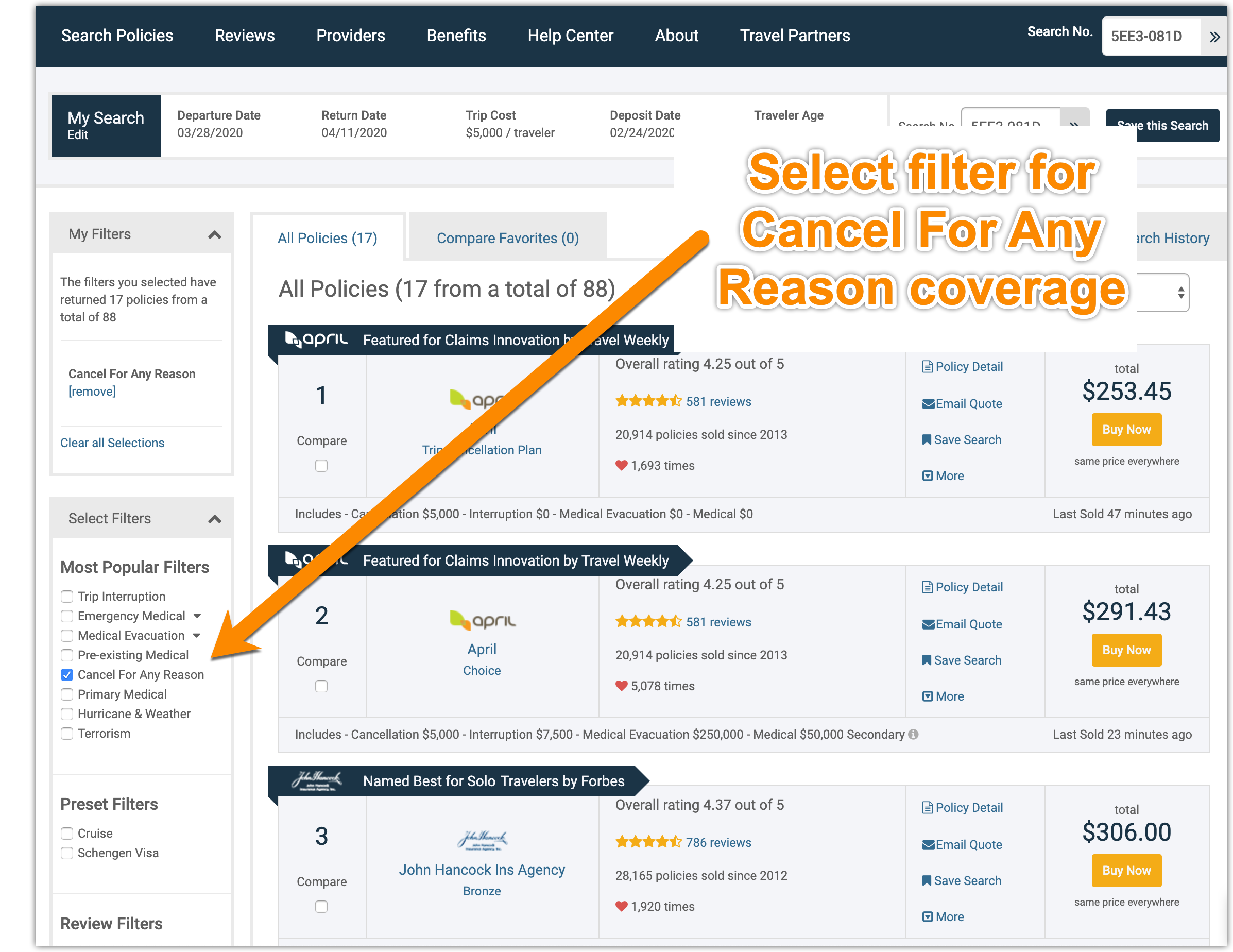

When considering a cancel for any reason policy, there are a few tips and considerations to keep in mind to make an informed decision.

Benefits of Opting for Cancel for Any Reason Policy

- Flexibility: Opting for this type of coverage gives you the freedom to cancel your trip for any reason that may arise, providing peace of mind.

- Unforeseen Circumstances: In uncertain times, having the option to cancel for any reason can protect your investment if unexpected events occur.

Cost Implications, John hancock travel insurance cancel for any reason

- Higher Premium: Cancel for any reason policies typically come at a higher cost compared to standard travel insurance due to the increased coverage.

- Value Assessment: Consider the value of your trip and the likelihood of needing to cancel before deciding if the extra cost is worth it for you.

Maximizing Benefits

- Understand Policy Terms: Familiarize yourself with the specific terms and conditions of the cancel for any reason policy to ensure you know what is covered.

- Timely Notification: If you need to cancel your trip, notify the insurance provider as soon as possible to initiate the claims process promptly.

- Keep Documentation: Maintain all relevant documents, such as receipts and medical records, to support your claim in case of cancellation.

Final Summary

In conclusion, John Hancock Travel Insurance Cancel for Any Reason provides a safety net for your travels, offering you the freedom to cancel for any reason. With comprehensive coverage and flexible options, this policy ensures you can travel with confidence.

Questions and Answers: John Hancock Travel Insurance Cancel For Any Reason

What does ‘cancel for any reason’ mean in travel insurance?

‘Cancel for any reason’ in travel insurance allows you to cancel your trip for any reason that is not covered under traditional trip cancellation policies.

What are the benefits of having a cancel for any reason policy?

A cancel for any reason policy provides added flexibility and protection, giving you the freedom to cancel your trip for any unforeseen circumstances.

How do I file a claim under John Hancock’s cancel for any reason policy?

When filing a claim, you will need to provide documentation such as proof of cancellation and reasons for not being able to travel. Contact John Hancock for specific details.

Are there any exclusions or limitations to this type of coverage?

Exclusions and limitations may vary, so it’s important to review the policy details to understand what is covered and what is not under the cancel for any reason policy.

When is it beneficial to opt for a cancel for any reason policy?

It’s beneficial to opt for this policy when you have concerns about potential trip cancellations or need added flexibility in your travel plans.