Insurance options for small business owners set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Exploring the various types of insurance, key factors to consider, customizing coverage, and cost management strategies, this discussion aims to provide valuable insights for small business owners.

Types of Insurance Options

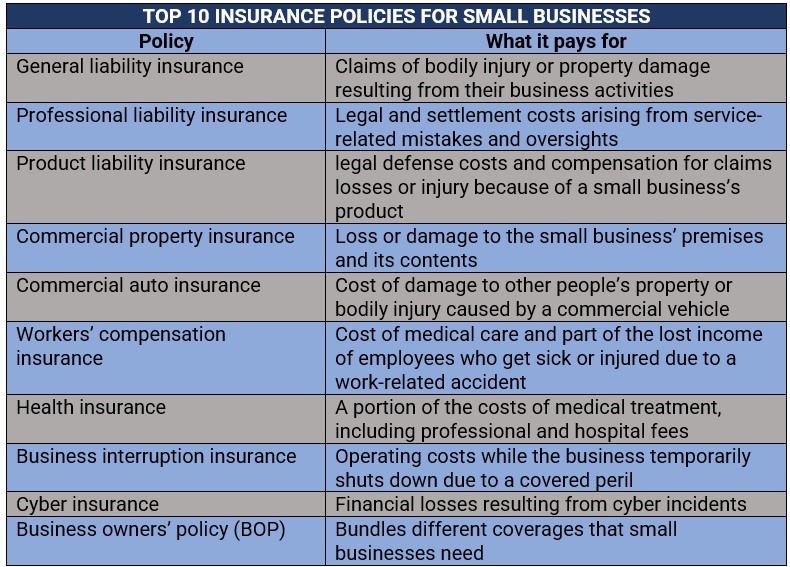

As a small business owner, it is crucial to have the right insurance coverage to protect your business from unexpected events. Here are some important types of insurance options to consider:

Liability Insurance

Liability insurance protects your business from claims of injury or property damage caused by your services, products, or operations. It can cover legal fees, settlements, and medical costs, providing financial protection in case of lawsuits.

Property Insurance

Property insurance covers your business property, including buildings, equipment, inventory, and furniture, from risks such as fire, theft, or vandalism. It helps you replace or repair damaged assets, ensuring business continuity.

Business Interruption Insurance

Business interruption insurance provides coverage for lost income and expenses when your business operations are disrupted due to a covered peril, such as a natural disaster. It can help you recover and stay afloat during challenging times.

Key Person Insurance

Key person insurance protects your business from financial losses that may result from the death or disability of a key employee. It provides funds to cover recruiting costs, training expenses, and revenue losses, ensuring the continuity of your business.

Factors to Consider

When selecting insurance options for their small businesses, owners must carefully consider several key factors to ensure adequate coverage and protection. The size and nature of the business play a crucial role in determining the most suitable insurance choices, while assessing risks and liabilities is essential to mitigate potential financial losses.

Business Size and Nature

- Small businesses with fewer employees may have different insurance needs compared to larger corporations. Owners should consider the size of their workforce and the extent of their operations when choosing insurance coverage.

- The nature of the business also influences insurance choices. For example, a retail store may require different types of coverage than a construction company due to varying risks associated with each industry.

Assessing Risks and Liabilities

- It is crucial for small business owners to conduct a thorough assessment of potential risks and liabilities they may face. This includes evaluating factors such as the location of the business, the type of products or services offered, and the regulatory environment.

- By identifying and understanding potential risks, owners can select insurance options that provide adequate protection against specific threats, such as property damage, liability claims, or business interruption.

Customizing Insurance Coverage

When it comes to insuring your small business, customization is key to ensuring that you have the right coverage for your specific needs. Here are some tips on how to customize insurance coverage to fit the unique requirements of your business.

Bundling Insurance Policies

One way to customize insurance coverage for your small business is by bundling different types of insurance policies together. By bundling policies such as general liability, property, and business interruption insurance, you may be able to save money on premiums while also ensuring comprehensive coverage.

Tailoring Coverage as Your Business Grows

As your business evolves and grows, it’s important to regularly review and adjust your insurance coverage to reflect these changes. For example, if you hire more employees, expand your operations, or introduce new products or services, you may need to increase your coverage limits or add additional types of insurance to protect your growing business.

Cost Management Strategies: Insurance Options For Small Business Owners

As a small business owner, managing insurance expenses is crucial to ensure financial stability and protect your business assets. Implementing cost-effective strategies can help you reduce insurance costs without compromising coverage. In this section, we will explore different ways to manage insurance expenses efficiently.

Comparing Insurance Quotes, Insurance options for small business owners

One of the first steps in managing insurance costs is to compare quotes from different insurance providers. By obtaining multiple quotes, you can identify the most cost-effective option that meets your coverage needs.

Increasing Deductibles

Raising your deductibles can lead to lower premiums, as you are agreeing to pay a higher amount out of pocket before the insurance coverage kicks in. However, make sure you can afford the higher deductible in case of a claim.

Reducing Coverage Limits

Review your coverage limits periodically to ensure they align with your business needs. Lowering coverage limits for certain policies can help reduce premiums while still providing adequate protection for your business.

Bundling Insurance Policies

Consider bundling multiple insurance policies with the same provider to qualify for discounts. Insurance companies often offer reduced rates for customers who purchase multiple policies, such as combining general liability and property insurance.

Risk Management Strategies

Implementing risk management strategies can help prevent insurance claims and lower premiums over time. By identifying and addressing potential risks in your business operations, you can minimize the likelihood of costly claims.

Last Point

As we conclude our exploration of insurance options for small business owners, it becomes evident that finding the right coverage involves a careful balancing act. By understanding the types of insurance available, considering key factors, customizing coverage, and implementing cost management strategies, small business owners can navigate the complex world of insurance with confidence and foresight.

Essential FAQs

How can small business owners determine the right amount of liability insurance coverage?

Small business owners should assess their business risks and liabilities carefully to determine the appropriate amount of liability insurance coverage. Factors such as the nature of the business, industry standards, and potential risks should all be taken into consideration.

Is it necessary for small business owners to bundle insurance policies?

Bundling insurance policies can be beneficial for small business owners as it often leads to cost savings and simplifies the insurance management process. By combining multiple policies from the same provider, small business owners can streamline their coverage and potentially reduce premiums.

What are some effective cost management strategies for small business owners when it comes to insurance?

Small business owners can explore various cost management strategies such as increasing deductibles, shopping around for competitive rates, implementing risk management practices to reduce potential claims, and periodically reviewing their insurance needs to ensure they have the right coverage at the best price.