Humana Health Insurance Medicare Supplement offers a range of benefits and coverage options designed to meet the healthcare needs of individuals. Let’s delve into the key features and advantages of choosing Humana for your Medicare Supplement coverage.

Introduction to Humana Health Insurance Medicare Supplement

Humana Health Insurance offers a variety of Medicare Supplement plans designed to provide additional coverage beyond Original Medicare. These plans are designed to help cover out-of-pocket costs such as copayments, coinsurance, and deductibles that Medicare does not cover.

Key Features of Humana’s Medicare Supplement Plans

- Guaranteed renewable coverage for life, as long as premiums are paid on time.

- Freedom to choose any doctor or hospital that accepts Medicare patients.

- No referrals needed to see a specialist.

- Coverage that travels with you nationwide, making it convenient for frequent travelers.

Benefits of Choosing Humana for Medicare Supplement Coverage

- Peace of mind knowing that you have additional coverage for unexpected medical expenses.

- Predictable costs with fixed monthly premiums that make budgeting easier.

- Dedicated customer service and support to help you navigate your coverage and answer any questions you may have.

Coverage Options

When it comes to coverage options, Humana Health Insurance Medicare Supplement offers a range of plans to meet the needs of Medicare beneficiaries. These plans provide additional coverage to fill the gaps left by Original Medicare, offering peace of mind and financial protection.

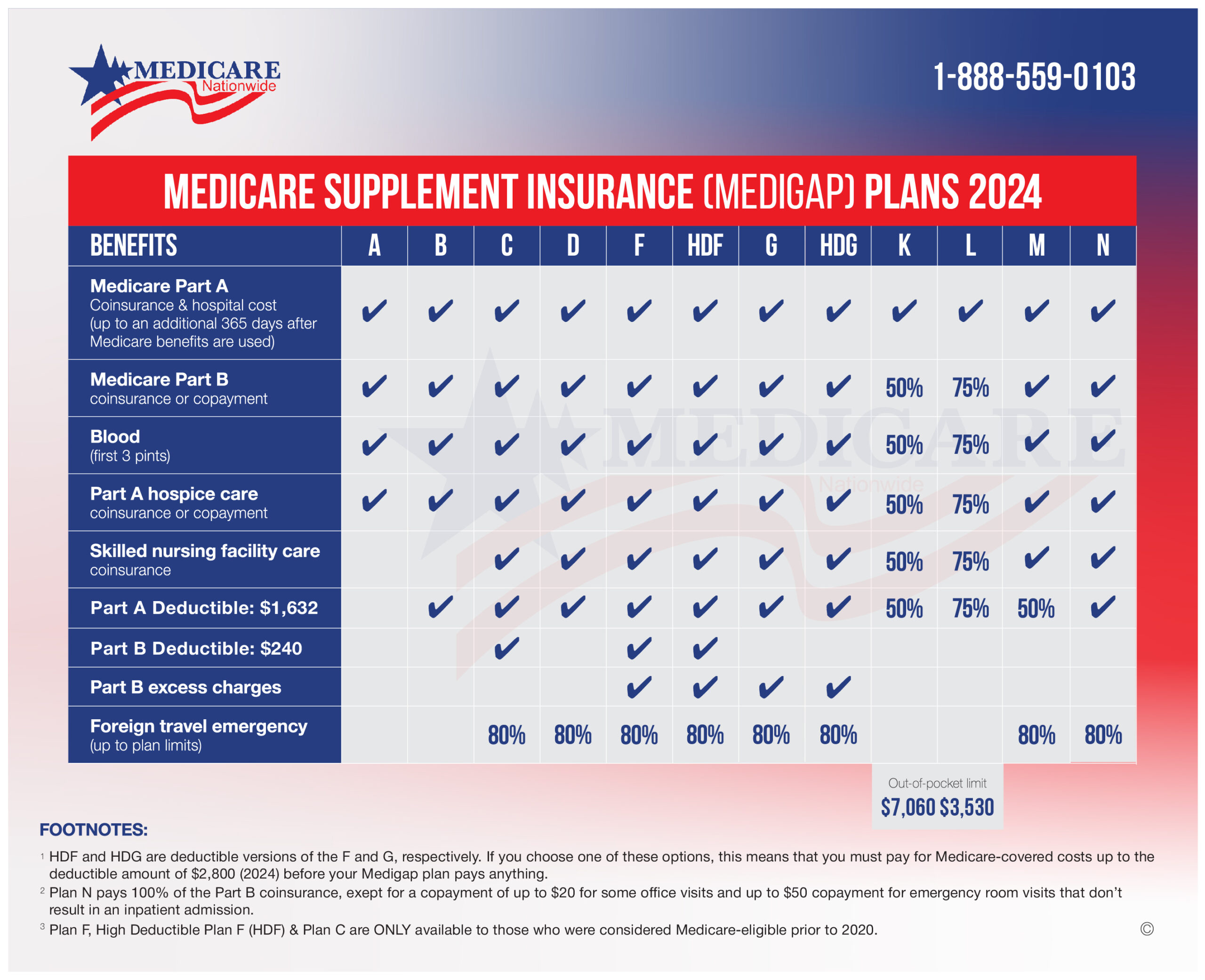

Different Plans Available

- Plan A: Basic benefits such as Medicare Part A coinsurance and hospital costs

- Plan B: Includes Plan A benefits plus Medicare Part B coinsurance

- Plan F: Most comprehensive coverage, including Part B excess charges and foreign travel emergency

- Plan G: Similar to Plan F but does not cover the Part B deductible

- Plan N: Covers Part A deductible, some Part B coinsurance, and copayments

Comparison to Other Providers

Humana’s plans are competitive in terms of coverage and cost when compared to other Medicare Supplement providers. With a wide range of options to choose from, beneficiaries can find a plan that meets their specific needs and budget.

Specific Medical Services Covered

| Medical Service | Plan Coverage |

|---|---|

| Hospital stays | Part A coinsurance and costs up to an additional 365 days after Medicare benefits are used up |

| Doctor visits | Part B coinsurance or copayment |

| Skilled nursing facility care | Part A coinsurance |

| Foreign travel emergency | Covered under Plan C, D, F, G, M, and N |

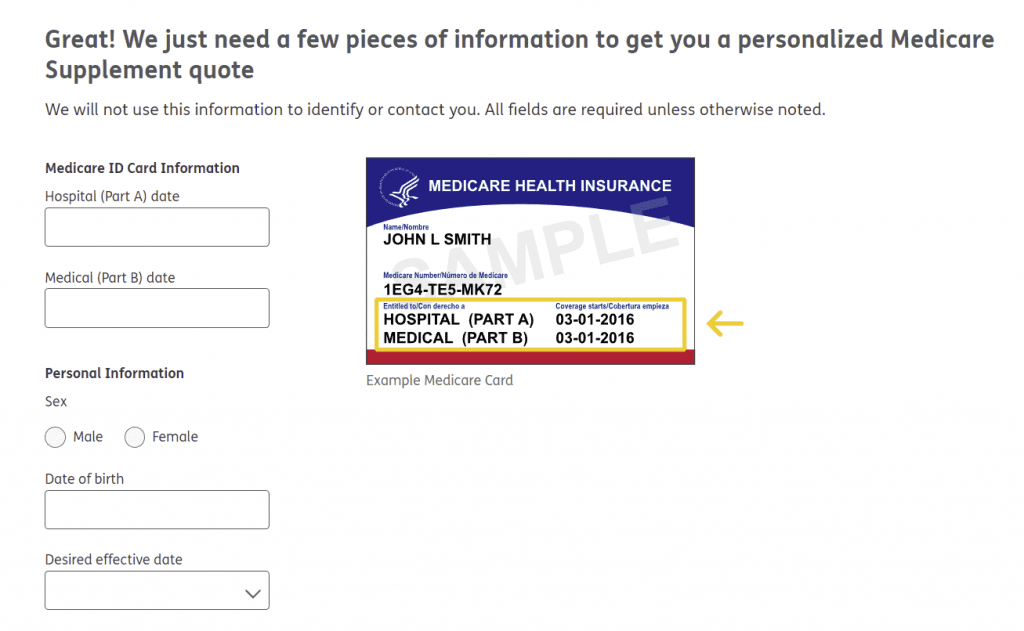

Eligibility and Enrollment

When it comes to enrolling in Humana’s Medicare Supplement plans, there are specific eligibility criteria that individuals need to meet. Below, we will discuss the eligibility requirements, the enrollment process, and any special considerations related to Humana’s plans.

Eligibility Criteria

- Individuals must already be enrolled in Medicare Part A and Part B

- Applicants must reside in the service area where the plan is offered

- Generally, you must be 65 years or older to qualify

- Some states may have additional eligibility requirements

Enrollment Process

- Visit the official Humana website to explore plan options

- Speak with a Humana representative to discuss your needs and preferences

- Complete the enrollment application either online, over the phone, or in person

- Review the plan details, costs, and coverage before finalizing enrollment

Special Enrollment Periods, Humana health insurance medicare supplement

Special enrollment periods may be available in certain situations, such as moving to a new state, losing employer coverage, or qualifying for Medicaid.

- During special enrollment periods, individuals have the opportunity to enroll in a plan outside of the usual enrollment periods

- It is important to understand the specific circumstances that qualify for a special enrollment period to take advantage of this opportunity

Cost and Pricing

When it comes to Humana Health Insurance Medicare Supplement plans, pricing is determined based on various factors such as the plan type, location, age, and gender of the beneficiary. It is essential to understand how pricing works to make an informed decision about which plan best suits your needs and budget.

Comparing Costs of Different Humana Plans

- Humana offers a range of Medicare Supplement plans, each with its own set of benefits and coverage options.

- The costs of these plans can vary depending on the level of coverage provided, with higher coverage plans typically having higher monthly premiums.

- It is important to compare the costs of different Humana plans to determine which one offers the best value for your specific healthcare needs.

Potential Discounts and Cost-Saving Opportunities

- Humana may offer discounts for beneficiaries who enroll in a Medicare Supplement plan during certain periods or for those who choose to pay their premiums through certain payment methods.

- Some beneficiaries may also be eligible for cost-saving opportunities such as household discounts for couples who both enroll in a Humana Medicare Supplement plan.

- It is recommended to explore all potential discounts and cost-saving opportunities with Humana to maximize your healthcare coverage while minimizing out-of-pocket expenses.

Network Coverage: Humana Health Insurance Medicare Supplement

When it comes to Humana Health Insurance Medicare Supplement, beneficiaries can benefit from a wide network of healthcare providers and facilities. This network plays a crucial role in ensuring that individuals have access to quality care when they need it the most.

The network coverage provided by Humana impacts the accessibility of care for beneficiaries in a positive way. By having a robust network of providers and facilities, individuals can easily find healthcare services within their local community or even when traveling to other regions.

Strong Network Presence in Certain Regions

Humana’s network coverage is particularly strong in states like Florida, Texas, and Ohio. In these regions, beneficiaries have a wide selection of healthcare providers and facilities to choose from, ensuring that they can receive the care they need without any hassles.

Customer Satisfaction and Reviews

When it comes to customer satisfaction, Humana’s Medicare Supplement plans have received positive feedback from beneficiaries who have enrolled in their coverage options. Many individuals have expressed their satisfaction with the comprehensive coverage and benefits offered by Humana.

Insights on Customer Satisfaction Levels

- Beneficiaries appreciate the ease of enrollment and the clarity of information provided by Humana regarding their Medicare Supplement plans.

- Many customers have highlighted the prompt and efficient customer service they have received from Humana representatives when seeking assistance or clarification.

- Overall, there is a sense of security and peace of mind among beneficiaries who have chosen Humana for their Medicare Supplement needs.

Common Feedback and Reviews

- Several beneficiaries have praised the flexibility of Humana’s network coverage, allowing them to access a wide range of healthcare providers and facilities.

- Customers have also commended the competitive pricing of Humana’s Medicare Supplement plans, making quality healthcare more affordable for many individuals.

- Positive reviews often mention the comprehensive benefits included in Humana’s plans, such as coverage for prescription drugs and preventive care services.

Accolades and Ratings

- Humana has received accolades for its commitment to customer satisfaction and quality of service in the Medicare Supplement market.

- The high ratings and positive reviews from industry experts and beneficiaries alike reflect the trust and credibility associated with Humana’s Medicare Supplement offerings.

- Accolades for Humana’s Medicare Supplement plans serve as a testament to the company’s dedication to meeting the healthcare needs of seniors and individuals with Medicare coverage.

Additional Benefits and Services

When it comes to Humana Health Insurance Medicare Supplement plans, beneficiaries can enjoy a range of additional benefits and services that enhance their overall coverage and provide added value. Let’s explore some of these extra perks and compare them to what other Medicare Supplement providers offer.

Dental, Vision, and Hearing Coverage

One of the standout features of Humana’s Medicare Supplement plans is the inclusion of dental, vision, and hearing coverage. This additional benefit goes beyond traditional Medicare coverage and helps beneficiaries maintain their overall health and well-being.

- Beneficiaries can access routine dental check-ups, eye exams, and hearing tests at no additional cost.

- Coverage may also include discounts on prescription glasses, hearing aids, and other essential services.

Fitness and Wellness Programs

Humana Health Insurance Medicare Supplement plans often include access to fitness and wellness programs to help beneficiaries stay active and healthy. These programs can range from gym memberships to virtual fitness classes and personalized wellness coaching.

- Beneficiaries can take advantage of discounts on gym memberships, fitness equipment, and wellness services.

- Access to online resources and tools for managing chronic conditions and improving overall health.

Nurse Advice Line and Telehealth Services

Humana provides beneficiaries with access to a nurse advice line and telehealth services, making it easier to receive medical guidance and care from the comfort of their homes.

- 24/7 access to qualified nurses for health-related questions and concerns.

- Virtual doctor visits for non-emergency medical issues, saving time and hassle for beneficiaries.

Summary

In conclusion, Humana Health Insurance Medicare Supplement provides extensive coverage, excellent network options, and additional benefits to enhance your healthcare experience. Consider enrolling today to secure comprehensive and reliable coverage for your medical needs.

FAQ Section

What are the eligibility criteria for enrolling in Humana’s Medicare Supplement plans?

Eligibility criteria typically include being enrolled in Medicare Part A and B, and meeting age requirements specific to each state.

How does pricing work for Humana Health Insurance Medicare Supplement plans?

Pricing is based on factors like age, location, and the specific plan chosen. Premiums may vary, so it’s important to compare options.

Does Humana offer any special enrollment periods for their Medicare Supplement plans?

Yes, Humana may offer special enrollment periods under certain circumstances, such as moving out of your plan’s service area.