Starting with AARP secondary insurance to Medicare, this comprehensive plan works in harmony with Medicare to provide enhanced coverage and benefits for individuals. Dive into the details below to understand how this insurance can benefit you.

Overview of AARP Secondary Insurance to Medicare

AARP secondary insurance to Medicare is a supplemental insurance plan provided by AARP to enhance the coverage offered by original Medicare. It helps fill in the gaps left by Medicare Part A and Part B, providing additional benefits and financial protection for healthcare costs.

How AARP Secondary Insurance Works with Medicare

AARP secondary insurance works in conjunction with Medicare by covering expenses that are not fully paid for by original Medicare. This includes copayments, coinsurance, and deductibles, offering policyholders greater peace of mind and financial security when accessing healthcare services.

Benefits of Having AARP Secondary Insurance along with Medicare

- Extended Coverage: AARP secondary insurance expands the scope of coverage beyond what Medicare provides, ensuring comprehensive protection for various healthcare needs.

- Financial Protection: By covering out-of-pocket costs, AARP secondary insurance helps policyholders manage their healthcare expenses more effectively, reducing the financial burden.

- Flexibility: With AARP secondary insurance, individuals have the flexibility to choose their healthcare providers and access a wider network of medical facilities, enhancing their healthcare options.

- Added Services: Some AARP secondary insurance plans offer additional services such as vision and dental coverage, wellness programs, and prescription drug benefits, further enhancing the overall healthcare experience.

Coverage Details

When it comes to coverage, AARP secondary insurance to Medicare provides additional benefits beyond what Medicare offers. This supplemental insurance helps cover costs that Medicare may not fully cover, such as copayments, coinsurance, and deductibles.

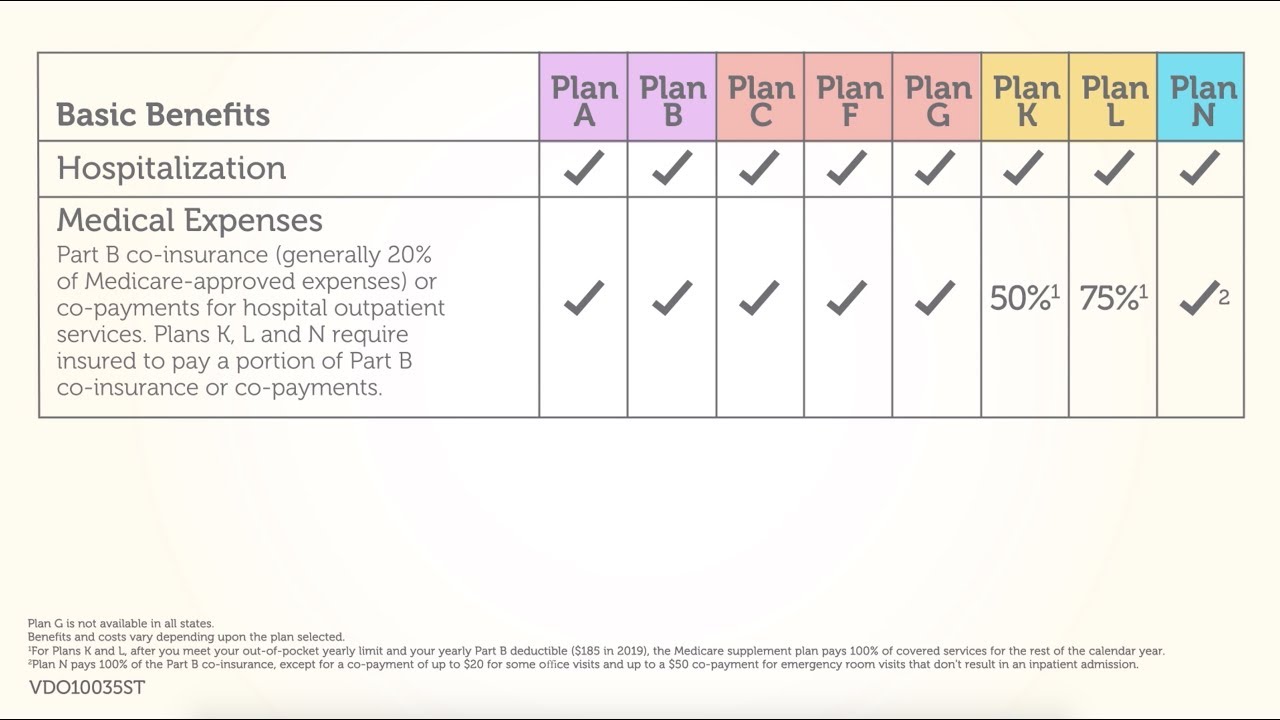

Comparison of Coverage

- AARP secondary insurance covers the gaps left by Medicare, providing increased financial protection for policyholders.

- Medicare typically covers about 80% of approved medical costs, while AARP secondary insurance can help cover the remaining 20%.

- Medicare does not cover prescription drugs, but AARP secondary insurance may offer prescription drug coverage.

Specific Services Covered

- Doctor visits: AARP secondary insurance can help cover the cost of seeing a doctor, including specialists.

- Hospital stays: This supplemental insurance can help pay for hospitalization costs not fully covered by Medicare.

- Prescription drugs: Some AARP secondary insurance plans include coverage for prescription medications.

- Medical equipment: Coverage may extend to durable medical equipment prescribed by healthcare providers.

Eligibility and Enrollment: Aarp Secondary Insurance To Medicare

To enroll in AARP secondary insurance to Medicare, individuals must meet specific criteria and go through a defined enrollment process. Below are the details regarding eligibility, enrollment, and any restrictions that may apply.

Eligibility Criteria

- Individuals must be enrolled in Medicare Part A and Part B.

- Applicants must be members of AARP to qualify for the secondary insurance.

- Age requirements may vary, but generally, individuals must be at least 65 years old to be eligible.

Enrollment Process

- Once eligible, individuals can enroll in AARP secondary insurance by contacting AARP directly or visiting their website.

- Applicants will need to provide their Medicare information and AARP membership details during the enrollment process.

- Enrollment periods may vary, so it is essential to enroll during the appropriate timeframe to ensure coverage.

Restrictions and Conditions

- Some AARP secondary insurance plans may have specific restrictions based on pre-existing conditions or health history.

- Enrollment eligibility may also be affected by factors such as location and plan availability.

- It is crucial to review all terms and conditions before enrolling to understand any limitations or restrictions that may apply.

Cost and Affordability

When considering AARP secondary insurance to Medicare, it is crucial to understand the associated costs and explore ways to make it more affordable.

Cost Breakdown

- AARP secondary insurance typically involves monthly premiums, deductibles, and co-payments. The exact costs can vary based on the plan you choose.

- It’s important to carefully review the details of each plan to understand the out-of-pocket expenses you may incur.

- Some plans may offer additional benefits at an extra cost, so consider your healthcare needs when selecting a plan.

Comparison with Other Options

- Compared to other supplemental insurance options, AARP secondary insurance may offer competitive pricing and comprehensive coverage.

- It’s recommended to compare the costs and benefits of different plans from various providers to determine the most cost-effective option for your situation.

- Consider factors like premium rates, coverage limits, and provider networks when evaluating different insurance plans.

Tips for Affordability, Aarp secondary insurance to medicare

- One way to make AARP secondary insurance more affordable is to choose a plan with a higher deductible, which can lower your monthly premiums.

- Consider bundling your insurance policies, such as combining your AARP secondary insurance with other coverage like dental or vision insurance, to potentially receive a discount.

- Explore available discounts or subsidies for seniors to help reduce the overall cost of your insurance coverage.

Customer Experience and Satisfaction

When it comes to customer experience and satisfaction with AARP secondary insurance to Medicare, it is crucial to consider the feedback and reviews from actual policyholders. Understanding common experiences and challenges faced by individuals with this insurance can help identify areas for improvement in the overall customer experience.

Customer Reviews and Feedback

- Many policyholders have praised AARP secondary insurance for its comprehensive coverage and affordable premiums.

- Some customers have noted quick and efficient claims processing, which has contributed to a positive experience.

- There have been instances where customers have mentioned helpful and friendly customer service representatives who have assisted them with their queries and concerns.

Common Experiences and Challenges

- One common challenge faced by individuals with AARP secondary insurance is navigating the complex healthcare system and understanding the coverage details.

- Some policyholders have reported issues with network limitations, especially when seeking care from out-of-network providers.

- Delays in claim processing and reimbursement have been a source of frustration for some customers.

Suggestions for Improvement

- Streamlining the claims process and improving communication with policyholders regarding the status of their claims could enhance the overall customer experience.

- Providing more comprehensive education and resources to help policyholders understand their coverage options and benefits can help alleviate confusion and improve satisfaction.

- Increasing network options and flexibility for accessing care can address concerns related to network limitations and improve the overall accessibility of healthcare services.

Ultimate Conclusion

In conclusion, AARP secondary insurance to Medicare offers a robust solution for maximizing your healthcare coverage. By enrolling in this plan, individuals can enjoy additional benefits and peace of mind in managing their medical expenses effectively.

Helpful Answers

Is AARP secondary insurance mandatory with Medicare?

No, AARP secondary insurance is optional and can complement your existing Medicare coverage to provide additional benefits.

What are the key benefits of having AARP secondary insurance?

AARP secondary insurance offers extended coverage beyond what Medicare provides, including assistance with copayments, deductibles, and other out-of-pocket expenses.

How can one enroll in AARP secondary insurance to Medicare?

To enroll, individuals need to meet the eligibility criteria, which typically include being an AARP member and already enrolled in Medicare. The enrollment process is straightforward and can be done through AARP directly.

Are there any restrictions on obtaining AARP secondary insurance?

While specific restrictions may vary, generally, individuals need to be Medicare-eligible and meet certain criteria set by AARP to qualify for their secondary insurance plan.

Can AARP secondary insurance be customized to fit individual needs?

Yes, AARP secondary insurance plans often offer flexibility in coverage options, allowing individuals to tailor their plan to suit their unique healthcare needs.