Does USAA bundle insurance? Starting off with this question, let’s delve into the benefits and details of bundling insurance with USAA. By exploring the concept of bundling insurance and how it can lead to cost savings, we will uncover the advantages of combining different types of insurance under one policy.

As we navigate through the various insurance options offered by USAA, including auto, homeowners, and renters insurance, we will also address eligibility requirements, customization possibilities, and customer satisfaction levels.

Overview of USAA Bundling Insurance

When it comes to insurance, bundling is a strategy where you combine multiple insurance policies, such as auto, home, and life insurance, with a single provider like USAA. This approach can offer various benefits to policyholders.

Benefits of Bundling with USAA

- Convenience: By bundling your insurance policies with USAA, you can manage all your coverages in one place, making it easier to keep track of your policies and payments.

- Discounts: USAA often provides discounts to customers who bundle their insurance policies, leading to cost savings on premiums.

- Customized Coverage: Bundling allows you to tailor your coverage options to suit your specific needs, providing a more comprehensive insurance solution.

Cost Savings with Bundling

When you bundle your insurance policies with USAA, you can potentially save money through the discounts offered for combining multiple coverages. This can result in lower overall premiums compared to purchasing individual policies from different providers.

Types of Insurance Offered by USAA

When it comes to insurance options, USAA offers a variety of coverage types that can be bundled for added convenience and savings.

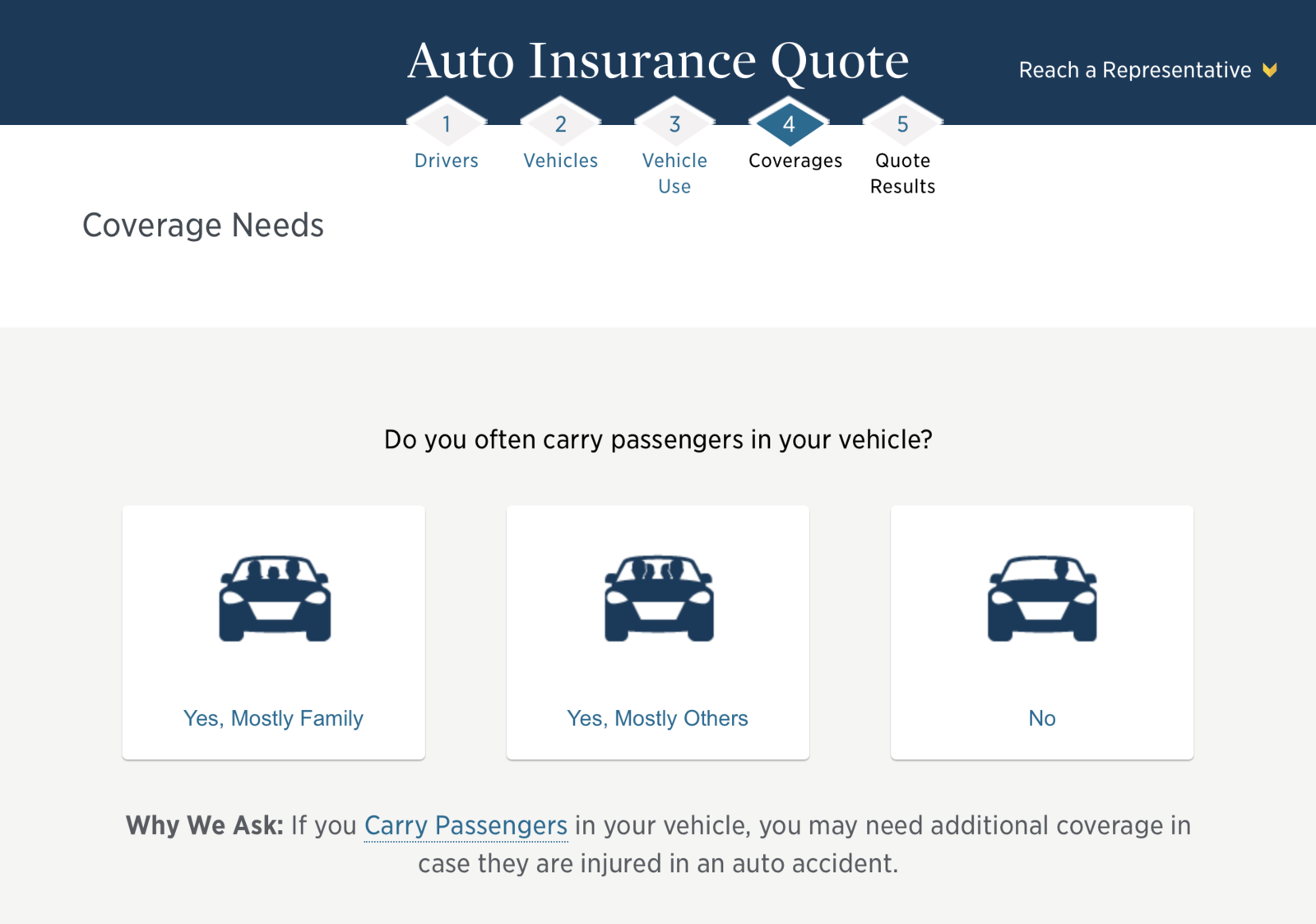

Auto Insurance Coverage Options

USAA provides comprehensive auto insurance coverage options to meet the individual needs of policyholders. Some key coverage options include:

- Liability Coverage: Protection in case you are at fault in an accident and need to cover the costs of the other party’s injuries or property damage.

- Collision Coverage: Helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you in case you are involved in an accident with a driver who does not have insurance or enough coverage.

Homeowners or Renters Insurance Coverage Options

For homeowners or renters, USAA offers comprehensive coverage options to protect your property and belongings. Some key coverage options include:

- Property Coverage: Protects the physical structure of your home or rental property in case of damage from covered perils like fire, theft, or severe weather.

- Personal Property Coverage: Covers the cost of replacing your belongings if they are stolen or damaged in a covered event.

- Liability Coverage: Provides financial protection in case someone is injured on your property and you are found liable for their injuries or damages.

- Additional Living Expenses Coverage: Helps cover the costs of temporary housing and living expenses if you are unable to stay in your home due to a covered event.

Eligibility and Requirements

To qualify for bundled insurance with USAA, individuals must meet certain eligibility criteria and adhere to specific requirements set by the company. There are also limitations and restrictions associated with bundling insurance policies that applicants should be aware of.

Eligibility Criteria

- Membership: USAA membership is limited to active, retired, and honorably separated officers and enlisted personnel of the U.S. military. Family members of eligible individuals may also qualify for membership.

- Location: USAA insurance products are available to individuals residing in the United States or select overseas locations.

- Financial Stability: Applicants must meet certain financial stability requirements to be eligible for bundled insurance policies.

Requirements for Bundling Insurance

- Minimum Number of Policies: USAA typically requires applicants to bundle multiple insurance policies, such as auto and home insurance, to qualify for discounts and benefits.

- Policy Types: Not all insurance policies offered by USAA may be eligible for bundling. Applicants should check with USAA to determine which policies can be bundled together.

- Premium Payment: Applicants must maintain active premium payments for all bundled policies to continue receiving discounts and benefits.

Limitations and Restrictions

- Discount Variability: The discounts and benefits offered for bundled insurance may vary based on the policies bundled, location, and other factors.

- Policy Changes: Making changes to one bundled policy may affect the discounts applied to other policies in the bundle. Applicants should consult with USAA before making any changes to their policies.

- Policy Renewal: Bundled policies may have different renewal dates, which could impact the overall cost and discounts associated with the bundle.

Customization and Flexibility

When it comes to bundled insurance packages, USAA offers a high level of customization and flexibility to meet the unique needs of each customer.

Customizing Coverage Limits and Deductibles

USAA allows customers to adjust their coverage limits and deductibles to create a personalized insurance bundle. This means that individuals can tailor their policies to ensure they have the right amount of coverage for their specific situation.

- Customers can choose higher coverage limits for certain types of insurance, such as auto or homeowners, to provide added protection.

- By adjusting deductibles, customers can control their out-of-pocket expenses in the event of a claim, balancing lower premiums with higher deductibles or vice versa.

- USAA provides guidance to help customers understand their options and make informed decisions when customizing their insurance bundles.

Customer Experience and Satisfaction

When it comes to bundling insurance with USAA, customer experience and satisfaction are key factors in determining the quality of service provided. Here, we will explore feedback from customers who have bundled insurance with USAA, the ease of managing multiple policies, and any customer service benefits related to bundled insurance.

Customer Reviews, Does usaa bundle insurance

- Many customers have praised USAA for their seamless bundling process, stating that it saved them time and money.

- Customers appreciate the convenience of having all their insurance policies under one account, making it easier to manage and track.

- Positive reviews highlight USAA’s excellent customer service and responsiveness to inquiries or claims related to bundled insurance.

Managing Multiple Policies

- Customers find it convenient to have all their insurance policies, such as auto, home, and life insurance, bundled under one account.

- Managing multiple policies under one account allows for easier payments, policy updates, and claims processing.

- USAA’s online portal and mobile app make it simple for customers to access all their policy information in one place.

Customer Service Benefits

- USAA offers dedicated support for customers who have bundled insurance, ensuring that their needs are met efficiently and effectively.

- Customers have reported quick response times and helpful assistance from USAA representatives when dealing with bundled insurance inquiries or claims.

- USAA’s commitment to customer satisfaction is evident in the positive reviews and high ratings received from customers who have bundled insurance policies.

Final Summary

In conclusion, bundling insurance with USAA offers a convenient and cost-effective solution for those looking to streamline their coverage. With the ability to customize packages, manage multiple policies easily, and benefit from excellent customer service, bundling insurance with USAA is a smart choice for many.

Essential FAQs: Does Usaa Bundle Insurance

What are the eligibility criteria for bundled insurance with USAA?

To qualify for bundled insurance with USAA, you typically need to hold multiple policies with them, such as auto and homeowners insurance.

Can customers customize their bundled insurance packages with USAA?

Yes, USAA allows customers to tailor their insurance bundles by choosing coverage limits, deductibles, and specific policy options.

How do customers benefit from bundling insurance with USAA?

Customers can enjoy cost savings, simplified policy management under one account, and potentially enhanced customer service benefits.